This applies in particular to transactions in the field of health (Article 261, 4, 1°), education and training services (Article 261, 4, 4°), real estate transactions (Article 261, 5), transactions carried out by non-profit associations (Article 261, 7), banking and financial transactions and insurance and reinsurance transactions (Article 261 C). However, mandatory electronic invoicing does not apply to transactions that are exempt from VAT under Articles 261 to 261 E of the General Tax Code, and exempt from invoicing. Such transactions are called business-to-business (BtoB) transactions. E-invoicing: electronic invoicing Which transactions are subject to electronic invoicing?Įlectronic invoicing concerns all transactions for the purchase and sale of goods and/or the supply of services carried out between companies established in France and subject to VAT when they are so-called domestic transactions, i.e. The platform must be able to provide you with a readable version of your invoice if you wish.

ELECTRONIC INVOICING SYSTEM FREE

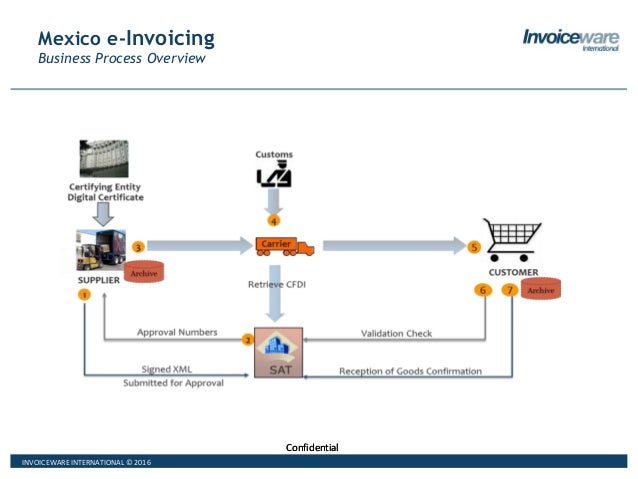

All companies are free to select the online platform(s) of their choice, a registered private platform and/or the public invoicing portal, based on their needs. Similarly, to issue invoices to your customers, you must use the services of a platform.

This may be the same platform as your supplier, a different platform, or the public invoicing portal. You will receive your suppliers’ invoices in electronic format through the platform(s) that you have chosen. How will I issue and receive my invoices? E-reporting makes it possible to reconstruct the overall economic activity of a company: supplementing electronic invoicing, it will eventually allow companies to benefit from pre-filled VAT return forms. These are transactions involving the sale of products and services to private individuals (or “business to consumer”, BtoC, transactions, such as retail trade) or transactions with operators established abroad (exports, intra-community shipments, etc.). the amount of the transaction, the amount of VAT invoiced) relating to commercial transactions that do not fall within the scope of electronic invoicing. What is e-reporting? Why send transaction data?Į-reporting is the transmission of certain information to the tax authorities (e.g. The term “e-invoicing” can refer to electronic invoicing.

ELECTRONIC INVOICING SYSTEM DRIVER

The universal adoption of electronic invoices guarantees savings for all companies and acts as a driver for modernising the invoicing chain by simplifying its management and monitoring and helping to reduce payment times. It will be sent to the customer via an online platform, whether this is the public invoicing portal or another online platform. In accordance with the new Article 289 bis of the General Tax Code, an electronic invoice is one that is issued, transmitted and received in paperless form and should include a minimum core set of data in a structured format, distinguishing it from a “paper” invoice or a standard PDF.

Since 1 January 2020, all French companies have been required to send their invoices to public sector entities in electronic format. I'm moving to electronic invoicing Why the move to extend electronic invoicing to between all companies?

0 kommentar(er)

0 kommentar(er)